- Venture Capital Mx

- Posts

- Startup Mx: Adquiere

Startup Mx: Adquiere

Adquiere is a platform designed to simplify mergers and acquisitions (M&A) for small to mid-sized businesses in LATAM.

Adquiere is a platform designed to simplify mergers and acquisitions (M&A) for small to mid-sized businesses in LATAM.

The platform bridges a significant gap by focusing on businesses often overlooked by traditional M&A firms due to their size.

“We don’t publish companies until they’re validated,” Daniel Rodriguez explains, emphasizing their commitment to quality and trust. The platform provides a secure ecosystem for both buyers and sellers, ensuring compatibility and mutual interest through its double opt-in system.

Often people think that “M&A” (Mergers and Acquisitions) is only for larger enterprises who have access to services such as investment bankers and law firms, but what happens when an SME wants to sell?

Adquiere was built to transform how businesses in Mexico and beyond access opportunities for growth and success. We aim to create connections that matter, empowering entrepreneurs and investors to unlock their full potential.

Adquiere’s Inception Story

Adquiere was created as a solution to the challenges Daniel Rodríguez observed in a previous exit as well as a deal that didn’t go through..

As a serial entrepreneur, Daniel saw that the M&A process was difficult for small and medium-sized enterprises (SMEs) and startups. Entrepreneurs had trouble finding reliable buyers, and investors often had a hard time discovering good opportunities.

“I saw how complicated it was for entrepreneurs to sell their businesses or for investors to find the right companies to buy or invest in. That’s when the idea for Adquiere came about.” - Daniel Rodriguez

The goal was to create a platform where business owners, buyers, and investors could easily connect, making the entire process more transparent and efficient.

Through Adquiere, we wanted to simplify the M&A journey. Our focus is on making it easier for both sellers and buyers to reach the best deals and, ultimately, help grow their businesses or investments.

The platform now serves as a space for verified investors and businesses looking to sell or raise capital, giving everyone involved a clear and secure way to conduct transactions.

Founders

How does Adquiere Work?

Adquiere simplifies the mergers and acquisitions (M&A) process, making it easy for entrepreneurs, buyers, and investors to connect and complete transactions efficiently.

With a network of over 210 verified investors and 110 registered businesses, the platform provides a professional environment to buy, sell, or invest in growing businesses. Each opportunity undergoes rigorous validation to ensure authenticity and transparency, giving users confidence in their decisions.

The platform supports users at every step of the M&A journey. Sellers receive assistance with company valuation, the creation of descriptive materials, and targeted connections to qualified buyers.

Buyers gain access to a curated list of validated businesses, while investors can explore vetted opportunities in startups and SMEs.

Comprehensive Services:

Valuation: Expert analysis to determine the company's value.

Descriptive Materials: Creation of key documents to showcase the business to potential buyers or investors.

Due Diligence: Full support in managing the audit process for transparency.

Negotiations: Professional representation and advice to secure favorable agreements.

Transaction Closing: Assistance in finalizing the deal to ensure a successful outcome.

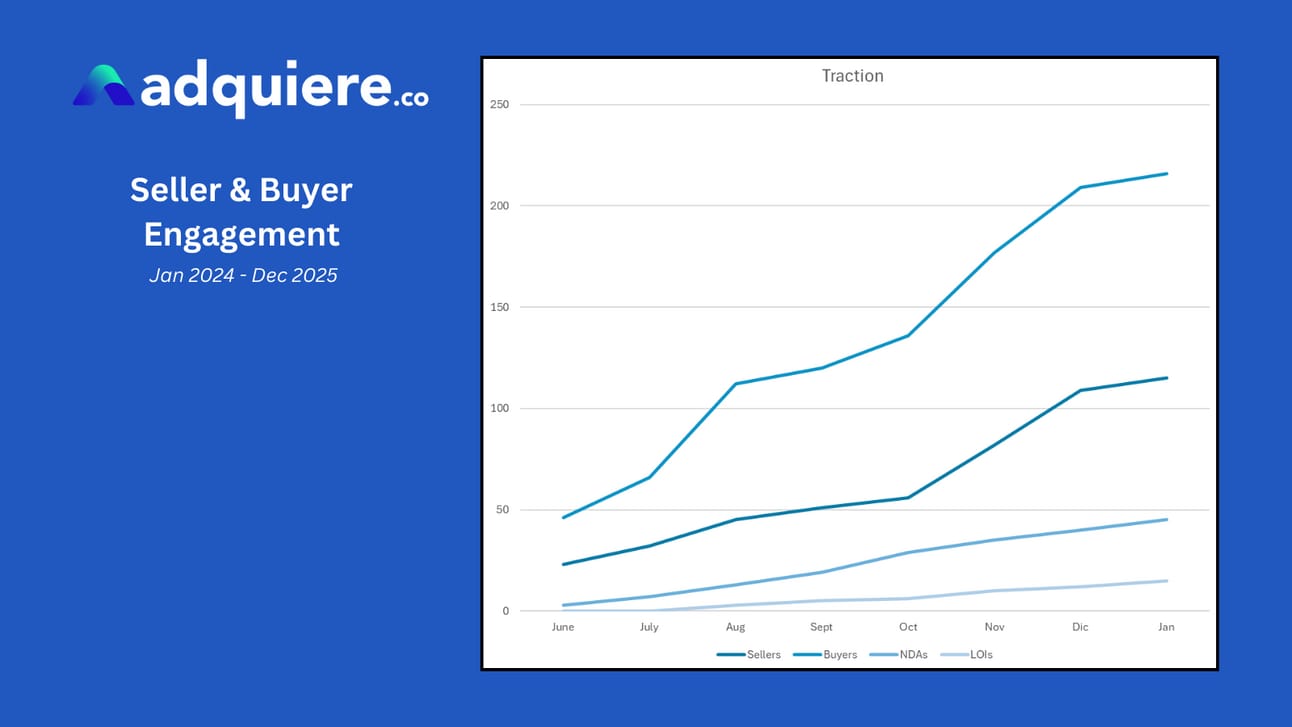

Traction

Since launching in June 2024, Adquiere has seen remarkable growth:

Sellers: 210+ (26% MoM avg)

Buyers: 110+ (33% MoM avg)

NDAs: 45+ (79% MoM avg)

LOIs: 15+ (22% MoM avg)

Funding

The company’s growth strategy also involves exploring funding options. Adquiere is considering raising a pre-seed round to accelerate development.

Daniel Rodriguez explained to VC Mexico:

“If we raise, we can start doing all of those things today rather than waiting a few months to close our first large deal. But we also have to ask—how much, with whom, and why?”

Automation and funding will enable Adquiere to refine its services without compromising quality. For example, the company plans to introduce tools that streamline the verification process, making transactions faster while retaining rigorous standards.

Rodriguez also highlights the scalability of their model:

Some deals on our platform progress independently, requiring minimal involvement from our team as buyers and sellers work directly together. While these smaller, straightforward transactions may seem insignificant individually, the cumulative value of hundreds of such deals can add up to a significant, and lower cost, revenue stream—showcasing the power of scale in our approach.

Adquiere’s growth strategy balances immediate operational needs with long-term scalability, setting the stage for sustained success.

Adquiere’s Roadmap

As Adquiere enters its first full year in 2025, the vision is centered on scaling its operations while maintaining the personalized service that defines its success. Automation plays a key role in these plans.

The leading M&A firms transact close to 800 deals per year and employ thousands of employees to achieve this with around .33 deals per employee per year. Our goal is to reduce the time and effort required to close a deal and achieve a 10x improvement, which would translate into 800 deals per year with around 200 employees.

Challenges and Misconceptions

Education is always emphasized in this process, particularly in educating the market and addressing misconceptions about M&A processes.

“There’s a lot to be done between wanting to sell your company and selling your company,” says Rodriguez, reflecting on the gap in understanding among business owners. Many entrepreneurs needed help navigating valuations and preparing for sales.

One common misconception in the M&A space is that all investors have the same profile. Rodriguez dispels this myth:

"It’s fascinating to see the diversity among our investors—ranging from high-net-worth individuals investing $1 to $10 million, to others making commitments of $50 to $250 million or even more. Our network spans angel investors, VCs, private equity, corporate venture capital, and family offices, creating a dynamic and varied ecosystem." - Daniel Rodriguez

By working closely with clients, Adquiere addresses these misconceptions and provides tailored guidance. This hands-on approach has helped build trust and clarity in an often opaque process.

“Startups and small businesses come to us saying, ‘I don’t know how to value my company.’ That’s where we step in,” Rodriguez adds, highlighting their role in simplifying the complexities of M&A.

Through education and personalized support, Adquiere has established itself as a reliable partner for businesses navigating the M&A industry.

Market Opportunity

In Latin America, mergers and acquisitions (M&A) have become the primary pathway for exits, driven by the limited availability of initial public offerings (IPOs). As of November 2024, the M&A market in the region has reached a cumulative value of $74 billion, according to Riot Times Online.

Despite this, many small and medium-sized enterprises (SMEs) in Mexico face significant barriers to entering the M&A space. The complexity of the process, particularly the difficulty in finding qualified buyers and navigating due diligence, often prevents SMEs from capitalizing on growth opportunities or achieving successful exits.

This underserved segment presents a clear opportunity for innovation. By simplifying access to M&A and streamlining the due diligence process, Adquiere can bridge the gap between investors and businesses, empowering SMEs to unlock their full potential and participate in the broader economic growth.

Advice for Aspiring Entrepreneurs

Reply